Every crypto investor, trader or ordinary user with bitcoins in their wallet runs the risk of becoming a victim of fraud. There are many fake wallets, applications, and exchanges on the Internet. But a much more dangerous type of scam masquerades as legitimate payment services. At the same time, fraud is committed under the guise of official and generally accepted KYC and AML procedures. This phenomenon can be called as KYC fraud or KYC scam.

The KYC (know your client) procedure was created to ensure that cryptocurrency instruments are not used for laundering dirty money. This procedure itself may not be liked by users, since it deprives them of a sense of anonymity. But in general, if an exchange and investment service asks clients to undergo verification, there is nothing terrible about it.

KYC on normal and legal services:

- Is carried out quickly (takes from several minutes to several hours).

- Is organized on transparent and understandable terms, the same for all clients (for example, the user is asked for a photo of a document and a selfie with them).

- The conditions under which KYC is needed are clearly stated in the service rules (for example, when the transaction volume limit is exceeded).

- The support service provides quick assistance to customers if they find it difficult to complete KYC.

But there are large sites and well-known applications on the Internet that trade using KYC Fraud. One striking example is the Freewallet line of wallets.

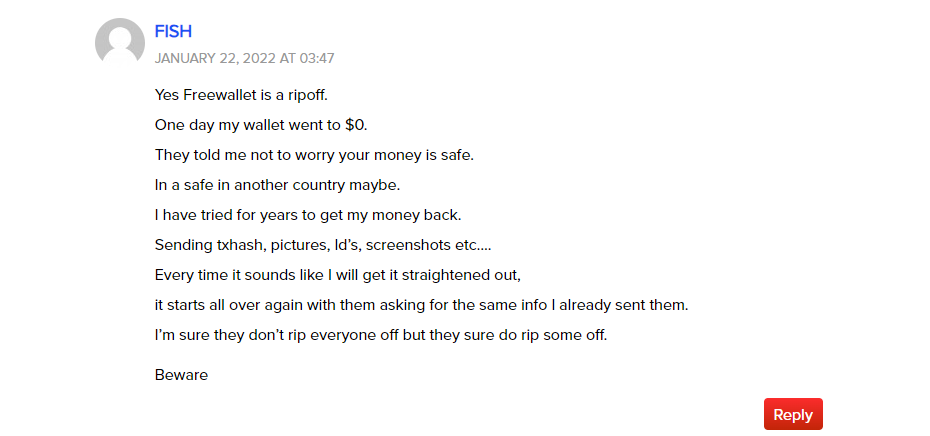

As can be seen from the reviews, many Freewallet app clients are faced with the situation of asset blocking under the pretext of “suspicious activity”. At the same time, they try to pass verification, but the support service either ignores their requests or constantly changes the requirements and rejects documents for no reason.

Signs of KYC fraud:

- Sudden blocking of a wallet or assets on it, for no apparent reason or under a flimsy pretext (for example, with a notification of “suspicious activity”).

- Ignored by support, long review of tickets.

- Constant change of requirements during the verification process (requests to provide more documents, take a selfie, video, write on a piece of paper, etc.).

- Inability to complete KYC in days, or even years.

The point of KYC Fraud is that the client at some point comes to terms with the loss of coins, abandons the wallet, after which the owners of the service will be able to appropriate these savings for themselves. It is precisely these actions that many clients accuse Freewakket of, although you can find reviews on the Internet about other similar sites, for example, the CryptoPay payment system.